How to Start a Small Business – A Veteran’s SMB Guide With Tools and Financial Resources

How to Start a Small Business – A Veteran’s SMB Guide With Tools and Financial Resources

As a veteran, many of the skills you learned in the military can be especially helpful in running a business. The wide range of hard and soft skills you acquired through service can be transferred with great success to the private sector. Many veterans are doing just that.

According to the United States Small Business Association (SBA), 2 1/2 million businesses are run by veterans. Nearly one in 10 U.S. businesses are veteran-owned. They cover the entire range of business types: from professional and technical services to consulting, construction, consumer products, and more.

While funding can be an obstacle for many new entrepreneurs, veterans have some advantages. Federal agencies are required to set aside a certain amount of funding for vets. This is especially helpful, given that many veterans lack sufficient credit history to obtain funding from traditional sources like banks.

In this guide, we outline the steps you’ll take to get a successful company off the ground. We’ll dive deep into each step and explain exactly what you need. We’ll introduce you to the wide range of excellent resources that can help you turn an idea into a successful business.

Incorporate your new business for $0

Don’t delay starting your new business. Incfile will form your new LLC business for $0. They handle all the admin – you just pay the state fees. Start now using this special discount link.

Find What You’re Looking For

Step One: Coming Up With Your Business Idea

Every good business begins with a good idea. Since you’re reading this article, you might already have a great idea that you’re trying to turn into a reality.

However, if you’re not in this category but still want to work for yourself, you’re not out of luck. It’s common for first-time entrepreneurs to spend as much time coming up with their business idea as they do getting it off the ground. The questions below will help you lock on to whatever business ideas could work best for you.

What Skills Do You Have?

The first question you’ll want to answer is whether you have any specific skills that would transition easily into starting a business. Chances are that you learned quite a large range of skills in the military that will translate easily into your own project. Did you work as an electrician? That might be a good answer. How about logistics? Even if these areas don’t fit, with some creative thinking you can come up with some good ideas. Do you have any other skills you obtained before joining the military? Those might also be of good use.

What Interests You?

The second question is whether there’s something that specifically interests you. This may be one of the most important things you need to answer. If you’re going to do a job and do it well, you’re going to want to like what it’s you do. If you enjoy something, the chances are that you’ll be better at it. Beyond that, having a passion for something you like to do will make your days go by a lot better. As the saying goes, if you love your job, you’ll never have to work a day in your life. It’ll be your driving force and what will get you out of bed in the morning. It could be that your hobby could become your profession.

What Resources Do You Already Have?

Thirdly, look at your existing resources. You might already have in hand various things that might suit you. For instance, if you already have access to a storefront ― perhaps it’s from a family business ― this can be a good start to getting you going. Similarly, if you have built up a solid tool shed and have a large set of tools, you might be already set up to begin some sort of maintenance, carpentry, or odd jobs business. Remember, one of the largest barriers to a business is expense. If you have anything already on hand, you’re already partially ahead of the game.

What Need or Niche Will You Fill?

Another thing to do is to look for an existing need in your community. There may be a shortage of people with a certain set of skills in your town or a business that doesn’t exist beyond a certain driving distance. You might find yourself filling a niche that has been needed for a long time. It never hurts to talk to people about what sort of things that they wish they had available to them. There may be a need that people have that they might not even realize. If you can come up with this, sometimes a simple need can be translated into a profitable business.

What Government Contracts Are Available?

Government contracts can be very lucrative, and veterans are often given special consideration when bidding them. Spend some time browsing the following resources, looking for opportunities that align with your skills and interests:

- U.S. Department of Veterans Affairs (VA): If you own a small business, you can be given special consideration when bidding on government contracts, but you need to register with the Vets First Verification Program first. Full details on the program can be found here.

- The National Center for Veterans Institute for Procurement: This organization exists to help veterans get a leg up when applying for government contracts. It provides a wide variety of training, mentorships, and exclusive offers.

- Veteran Business Outreach Center (VBOC): Part of the SBA, the VBOC provides resources for veterans who wish to start their own businesses, including training, counseling, and mentoring.

- Veteran Entrepreneur Portal: This is a division of the VA, which provides access to federal services and best practices to help veterans in all stages of business creation.

- Service-disabled Veteran-owned Small-business Program: If you have become disabled through your service, this division of the SBA helps connect veterans with government contracts.

- VetBiz: Another division of the VA, VetBiz is a portal for verification, acquisitions, and management support. It helps veterans find verified firms and offers training, communications, and assists in setting up events.

Step Two: Developing Your Business Plan

An often-overlooked area of starting a business is the need to create a clear business plan ahead of time. You need to have a plan in place to get from where you’re now to where you want to be. It’s best to lay out this information well before you begin. Set a few milestones, including dates, for how you plan on obtaining a set of individual goals.

Not only is this a good idea, and helps you find a way of measuring your success, but it’s also necessary if you intend on getting some help in financing your business. We’ll address this a bit later in this article.

What Should a Business Plan Include?

A business plan is a document that provides a summary or overview of your business, including a simple summary that can be presented to potential investors or others interested in your ideas, an overview of how you plan on running your company, analysis of the market ― who is your competition ― how your business will be organized, how you plan on developing and producing a product ― if that’s your plan ― financial projections, and more. Let’s break these down.

Executive Summary

The first part of your business plan will be an executive summary. An executive summary provides a quick overview of your entire business plan. It’s useful for readers to get a brief glimpse of your plan without having to read the entire document. In most cases, the entire document will be read, but this serves as an introduction to make absorbing the information easier. You should consider this to be one of the most important parts of your entire business plan. It should have the following pieces.

The Mission Statement

This should be a brief paragraph describing what your business is, and what needs it’s attempting to meet. Define your higher-level goals here, including what you wish to accomplish.

General Information

Here’s where you can provide some insight into the thinking behind your business. For example, you should include when it was formed, and who you are. Include everyone involved in creating the business, such as your business partners, and list what roles each of you’ll fulfill, the number of employees you have or expect to have, and where it’s located.

Highlights

If you already have started your business, this is a good place to mention any milestones you have already achieved. Include your gross earnings or other financials. It’s normal to want to bolster your credentials by including overly rosy information about your financial achievements. However, it’s important to tell the truth here, especially since this will come into play at some point in the future when you pay your taxes. The point, however, is to provide a positive snapshot of where your business is and where it’s going based on these numbers.

Products and/or Services

This is where you describe what product or services your business provides. Outline who your primary customers are or will be.

Financials

This section is crucial if you plan on getting any financial assistance from an official outside source, such as a bank or loaning institution, or if you plan on selling equity in your business. If you have any existing loans or grants, you should list these here.

Plans

Explain how you intend for your business to grow. You should create several projections about where you plan or wish your business to be in the next three to five years.

Company Overview

After you have constructed your executive summary, you’ll want to go into some more detail about your company and the unique proposition that you have constructed, including your plan on how you’ll be successful.

You’ll want to give a brief pitch for what your company does that nobody else already does ― at least in your area. Failing that you can go into an explanation for why you’re better than your competition. Think of this as a brief statement that you might commit to memory so that you have an answer for when someone asks you what it’s you do.

After this, provide a value proposition. Go into some detail about the nature of the existing market and why you’ll help fill a gap that exists. You’ll also want to describe the structure of your company. Is this something you’ll be running by yourself? Will you have partners? How many employees will you have, and what roles will they fulfill? Here, you’ll also want to explain how you’re legally set up. We’ll go into some detail later about various types of legal business types there are.

Market Analysis

Before going into business, it’s important to have a clear sense of the landscape. What’s your competition? Are there many competitors in your niche reaching your particular area? You should identify how much money is typically spent on your product or service, and research what possible areas there are for growth.

Describe your industry in general, report on market trends, and provide the outlook for how your general segment of this market sector will trend in the near future.

Identify who your target market is. You may want to draw up a few personas that would represent your ideal customer. How old are they? Are they predominantly male or female? How much money do they have available to spend? You’ll also need to clarify how long it’ll take to get your product to your consumer from the moment they request it to the moment you deliver it.

Next, you’ll need to provide detailed results of any market research that you have done. Identify by name who your top competitors will be. Identify if there’s more work available than they can provide. This may be true in many service sectors. For instance, it can often be several months between the time a customer requests, say, a roofing job to be done and the time that your competition can fulfill this request. If it’s more than a month or so, you have a great opportunity here.

Business Organization

Define your business’ management structure here. You’ll need to include how many employees you’ll have, and what roles they’ll fulfill. Define your ownership structure here as well. If you’re a sole proprietor, with no employees, say so. If there are several other people who have invested equity into your company, explain their roles.

This is also a good place to bring up your background as a veteran. If you’re forming this business with several other veterans, include that information here as well. This will come in particularly handy if you’re attempting to get some funding from a source that specializes in supporting veterans.

If you need people with specific talents, you’ll need to identify what roles you need to fulfill, and what sort of credentials and experience you’ll expect from them.

Product Development Plan

Here’s where you cover what services or products you intend to sell. Provide a basic description of the product or service. Describe how it meets the needs of your potential customers or clients. Explain why your product or service is better than your competition. If it’s a new product, go into detail about what it is, and what features it has. If it’s new, is it available right away or do you need investment to get it created and produced? Explain all of this. If you need to do more research, that’s okay, but include this in your plan, including the research you plan on doing, and what resources you need to accomplish your goals.

Do you plan on relying on external vendors or manufacturers for providing you with the product? Explain this clearly, including how to get needed materials and supplies.

If you’re entering into the tech sector, you’ll likely want to make some statements about your intellectual property. Digital products are relatively easy to steal so make sure you have covered the mental labor you have put into creating your tool or product. Make sure you register or patent any inventions and list those patent numbers here.

Financial Plan

Money is important for running most businesses. There’s a high chance that you may not have a large amount of money available, but it’s very important to outline what it’s you do have and how you plan on raising the necessary capital.

Provide records for your:

- Income

Cash flow

Bank balances

If you have any documentation on accounts receivable (A/R) or accounts payable (A/P), you’ll need to list these out as well.

Remember, if you’re attempting to get a loan from a bank or other source, this information will need to be accurate and verifiable.

You also need to plan out for the future. You should create statements on your:

- Projected earnings

- Projected cash flow

- Balance statements

- Expenses, including any initial capital expenditures, such as machinery or equipment you need to buy

If you are trying to get money from outside sources, make this explicitly clear here. How much do you need at this moment? Will you need more in the future? Explain all of this.

Step Three: Registering Your Business

Now we need to get into the nitty-gritty of going through the legal procedures for operating a business. It may seem like a pain but it’ll save you many problems in the future.

Choose a Business Name

This part might seem easy, or it may be difficult. Either way, once you’ve come up with a good brand name, you’ll need to register that name with your local state authorities as a doing business as (DBA). This will enable you to cash any checks issued to that business into a bank account you create for your company.

Define Your Legal Structure

These are the main types of businesses:

- Sole proprietorship: This is what it sounds like. You’re the only person in your business, and you have no employees. This is simple, and it’ll enable you to do business as yourself. Don’t forget to register your DBA.

- Partnership: If there are at least two people involved, this is a partnership. You’ll need to hire a lawyer to draft a formal agreement between the two or more of you.

- Corporation: Corporations are far more complicated. These are separate legal entities owned by shareholders, which will require incorporation. Most businesses starting out may not wish to do this, but there are many legal advantages, such as the fact that you personally won’t be subject to any losses gained by the company.

- S corporation (S-corp): Similar to corporations, but slightly different, S-corps can avoid the double taxation that can occur for regular corporations.

- Limited liability company (LLC): LLCs are combinations of partnerships and corporations. Those who own shares in an LLC aren’t liable for losses incurred by the business. Taxes pass through to the shareholders.

- Franchises: Although not exactly a legal entity, franchises are a great option for those who might find starting a business from scratch to be overwhelming. In franchises, you don’t specifically own the company but do own the income you generate for your individual franchise. In a good franchise, you’ll typically receive a lot of marketing help in selling an already established brand.

Register for Taxes

Don’t forget this. Your company once it has been established legally will need to be registered with federal and, where applicable, state and local authorities. You’ll likely need to get an employer identification number (EIN), although, in some cases, you can use your Social Security number. Check with the federal government to find out if you need one.

Get Your Documents, Licenses, and Permits

While this may be a chore, this is important. These vary from state to state and locality to locality and depend on what your specific product or service is. You’ll need to research before you even think of getting started.

Step Four: Funding Sources for Veteran-owned Businesses

You may need money to get started. The good news is that there are a lot of places you can look for help.

Crowdfunding

If you have a new and innovative product that will interest many people but hasn’t yet been realized, crowdfunding sources, such as Kickstarter, may be a great place to get funding. People will often contribute money in advance for a new product for a chance of getting their hands on this new product or a special offer in advance. It’s a form of small-level investing that has launched many new businesses.

Loans

You may be able to get a loan from your bank or, even better, as a veteran you may find that you can obtain a loan from places that specialize specifically in providing loans to those who have served in the armed forces.

Beyond banks, you can consider using the Veterans Business Fund. This is a nonprofit organization designed to provide veterans with the resources and loans that they need to begin their journey into the business world. This fund isn’t currently accepting new applicants but is expected to resume soon.

Grants

Some organizations will give you money outright in the form of a grant, which you don’t need to repay. Here are a couple that are available:

- Warrior Rising Veteran Grants: This organization helps connect veterans to funding sources. It focuses on individual “vetrepreneurs” and helps them get started in viable business opportunities.

- Idea Cafe Grants: This organization provides grants for entrepreneurs of all shapes and sizes. They specialize in smaller grants of under a few thousand dollars, but also offer a variety of other instructional resources.

Veterans’ Resources for Starting and Managing Their Business

Beyond funding, there are several other resources available to help veterans run their companies.

Work With the Government

One area that may seem like a natural fit for many veterans is to work directly with the federal government as an independent contractor. If you’re a veteran you already have experience working for the government. Therefore, why not convert them into a business partner or customer?

To be able to do business with the government, you need to be registered as a government contractor. This is a necessity if you plan on having the government as a customer. You’ll also need to become familiar with the General Services Administration (GSA) that is the agency which manages any contracts with the government.

If you’re looking for help, here are a couple of resources:

- Veterans’ Institute for Procurement (VIP): Many veteran-owned businesses got their start with a single government contract. VIP is a certification program that helps veterans get approved to apply for a wide variety of often lucrative government procurement contracts.

- The System for Award Management: Provides a portal for existing contractors, but its main purpose is to help companies register to do business with the U.S. government in the first place. Its site lets you register, renew, or check the status of an existing application.

Of course, there are resources not directly tied to the government. There are many nonprofits that will help as well. One such organization is the National Veteran Small Business Coalition, which is one of the more comprehensive and full-service organizations. It offers networking opportunities, support in finding funding and seeking mentorships. It’s veteran-run and very much veteran-focused.

Education

Maybe you’re just looking for some good resources to help you learn how to navigate these sometimes treacherous waters of beginning a business. There are a wide range of companies that can help provide courses and information that you may need, including:

- Boots to Business: This is another great resource from the Small Business Administration including crash courses on starting and running a business for veterans. It has resources to help veterans with their businesses, whether just starting out or already established.

- V-WISE: This is an organization that provides business education specifically for female veterans. It offers training for a whole range of business skills, including business planning, financing, marketing, access to capital, business law, and more.

- Entrepreneurship Bootcamp for Veterans: Specifically geared to veterans from the post 9/11 era, it’s also available to families who are caring for veterans. It offers a wide variety of training seminars across the country.

- Vet to CEO: An organization run by and for veterans to help former members of the military become successful entrepreneurs. It uses online training to bring veterans up to speed on the basics of starting, funding, and running a business.

Networking and Mentorships

One of the key parts of business is connecting with other business owners. Here are many useful resources for veterans:

- SCORE: This organization provides many mentoring workshops, some in collaboration with Facebook. Its searchable database lets veterans search for and find experienced mentors, people who’ve “been there, done that” in the business world and can help you do it too.

- American Corporate Partners: This group has helped more than 20,000 veterans enter the business world through its large network of mentors, many coming from some of the largest, most successful Fortune 500 companies in the nation.

- Vets In Tech: Provides mentoring and workshop opportunities for veterans looking to transition into the tech industry. It has a job-search board and a place for you to post your resume. A job in a tech company is an excellent way to prepare you to someday start your own.

- Hire Heroes USA: Offers free job search assistance to U.S. military members, veterans, and their spouses, and it helps companies find opportunities to hire them. It has helped 52,000 veterans and military spouses get hired.

- Patriot Bootcamp: Helps veterans network with each other to innovate in the business sector. It also arranges periodic training sessions around the country, helping veterans pick up extra skills that they can use to start their first venture.

Disabled Veterans Resources

If you have a veteran-related disability, you may want to check out some of these resources:

- Service-Disabled Veteran-Owned Small Business Program: Run by the SBA, this program helps veteran-owned businesses secure government contracts, especially those earmarked for veterans.

- Vets First Verification Program: Exists to help disabled veterans gain valuable government contracts, specifically those set aside by the VA. It has extensive information on and can help you navigate all the rules and regulations involved.

Free or Discounted Business Software for Veterans

There’s a range of companies who provide useful savings for veterans, which may be useful in your business:

- Microsoft: Microsoft offers up to 10% off select products and services. The discount includes business products and services like PCs, Microsoft 365, and mobile products. The discount applies to active-duty service members, veterans, and Reserve and National Guard personnel as well as their family members.

- Nimble: Entrepreneurial U.S. service members can receive one free year of Nimble CRM software. This is especially beneficial to veterans taking advantage of Microsoft’s offer as Nimble integrates seamlessly with Office 365 as well as G Suite. The Nimble CRM combines contact management, social media, sales intelligence, and marketing automation to help manage and grow your business development.

- Netsonic: Netsonic is a veteran-owned hosting service dedicated to supporting and showing appreciation for its fellow U.S. military personnel. When starting a new account, simply select the semi-annual billing cycle and enter promo ― PROMO CODE USA ― to apply the discount to basic, advanced, or webmaster shared hosting plans.

Additional Resources

The Office of Veterans’ Business Development (OVBD): This is the SBA’s liaison with the veteran’s business community. Its “mission is to maximize the availability, applicability, and usability of all administration small business programs for veterans, service-disabled veterans, reserve component members, and their dependent survivors.” The OVBD assists with training, counseling, mentorship, and oversight of federal entrepreneurship programs.

VetFran: Extensive research shows that veterans regularly find success as franchisees. The veteran’s success is due to the unique match of skills and aptitude needed to meet the rigorous demands of small business ownership. Veterans make up approximately 14% of all franchisees in the U.S. and VetFran encourages and facilitates the franchisor/franchisee partnership by encouraging discounts and incentives from the former while providing resources and tools to the latter.

Bunker Labs: Bunker Labs is a nonprofit that organizes events bringing military-connected entrepreneurs and veteran small business owners together. Bunker Labs’ online entrepreneurship curriculum helps aspiring business owners move their business from idea to fruition. Ongoing support from the community allows Bunker Labs to provide practical tools and resources to veteran business owners.

Institute for Veterans and Military Families (IVMF): The IVMF focuses on advancing the post-service lives of our nation’s military veterans and their families. Syracuse University and JPMorgan Chase & Co are its main supporters and, through its world-class advisory board, provide career training, entrepreneurship education, and actionable research which helps foster small business ownership of veterans and active-duty military spouses.

National Veteran-Owned Business Association (NaVOBA): The NaVOBA is another non-profit on our list. It supports businesses that are at least 51% owned, operated, or controlled by veterans by providing networking opportunities and training events. The NaVOBA works with more than 135 of the world’s largest corporations to engage and ensure veteran business enterprises (VBEs) are procurement-ready.

GovConOps: GovConOps is a consulting group for government contractors. Its focus is on preparing contractors for success in the preaward and post-award phases of government contracting. Its managing principals and directors have more than 15 years of combined experience producing favorable dispute resolution results. This service is on top of providing services such as audit and investigation assistance, contract advisory and compliance services, business development, and marketing.

Conclusion

Starting a business isn’t easy. As you have read, there’s much to think about when you’ve endeavored to enter into this realm. However, as a veteran, courage is one thing you likely don’t lack.

It’s still difficult, but the good news is that there are some fantastic opportunities for veterans. I hope this guide will serve you well.

Most Read

OVERCLOCKED AMD RYZEN 7 PERFORMANCE GUIDE

Coping with War: How ancient warrior transition compares today

Going Back to School in Your Civilian Life

The Veteran’s Guide to Getting Started as a Business Owner

Digital Marketing with Videos

Tags

Semper Fi Design Web Development Team

Over 8 years experience in website design and development, now offering digital marketing and more...

Tags :

Share :

Leave a Reply Cancel reply

Recent Post

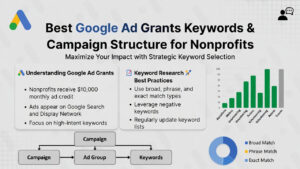

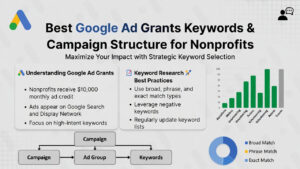

Best Google Ad Grants Keywords & Campaign Structure for Nonprofits

Google Ad Grants Rules & Compliance (Avoid Suspension)

How to Qualify for Google Ad Grants

Best Ecommerce Website Creator (2026): Shopify vs WooCommerce

Get Connected

Latest Products

Dark Block Camo Unisex Pullover Hoodie – Made in USA | Cut & Sew Sublimation

Urban Jungle Green Camo Hoodie – American-Made Tactical Performance Hoodie

Recent Post

Best Google Ad Grants Keywords & Campaign Structure for Nonprofits